In the rapidly evolving landscape of October 2024, businesses and investors are reliant on key sentiment indicators to navigate the unpredictable market conditions and make informed decisions. Understanding and tracking these indicators is crucial for staying ahead and gaining a competitive edge. Let’s delve into a few essential sentiment indicators that are likely to shape the business environment in the coming months.

**1. Consumer Confidence Index (CCI):**

The Consumer Confidence Index serves as a reliable gauge of consumer sentiment and spending intentions. A high CCI indicates that consumers are optimistic about their financial prospects, leading to increased spending and economic growth. Conversely, a declining CCI may signal economic uncertainty and subdued consumer spending. Tracking CCI trends provides valuable insights into consumer behavior and market trends, allowing businesses to adjust their strategies accordingly.

**2. Business Confidence Survey:**

The Business Confidence Survey reflects the sentiment of businesses regarding economic conditions, investment plans, and growth expectations. High business confidence levels often translate into increased investments, expansion initiatives, and job creation. Monitoring the results of the Business Confidence Survey helps businesses anticipate shifts in the economic landscape, identify emerging opportunities, and adapt their business strategies to capitalize on favorable conditions.

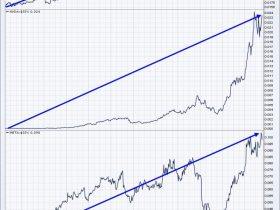

**3. Stock Market Volatility Index (VIX):**

The Stock Market Volatility Index, commonly known as the VIX, measures market volatility and investor fear or complacency. A high VIX suggests increased market uncertainty and potential downside risks, while a low VIX indicates investor confidence and stable market conditions. By tracking the VIX, investors can gauge market sentiment, assess risk levels, and make well-informed decisions about their investment portfolios.

**4. Social Media Sentiment Analysis:**

With the proliferation of social media platforms, sentiment analysis has become a valuable tool for gauging public opinion and sentiment towards brands, products, and markets. By leveraging sentiment analysis tools, businesses can monitor online conversations, identify emerging trends, and proactively address any negative sentiment or issues that may impact their reputation. Social media sentiment analysis provides real-time feedback and insights that can inform marketing strategies, product development, and customer engagement efforts.

**5. Economic Policy Announcements:**

Government policies and central bank decisions play a significant role in shaping market sentiment and business confidence. Key economic policy announcements, such as interest rate changes, fiscal stimulus packages, and regulatory reforms, can have a profound impact on financial markets and investor sentiment. Staying informed about upcoming policy decisions and their potential implications can help businesses adapt to changing market conditions and mitigate risks.

As businesses navigate the dynamic landscape of October 2024, tracking key sentiment indicators is essential for making informed decisions, managing risks, and seizing opportunities. By staying attuned to consumer confidence, business sentiment, market volatility, social media sentiment, and economic policy developments, businesses can proactively adjust their strategies to stay ahead of the curve and thrive in a competitive environment. By leveraging these sentiment indicators effectively, businesses can position themselves for success and sustainable growth in the months ahead.