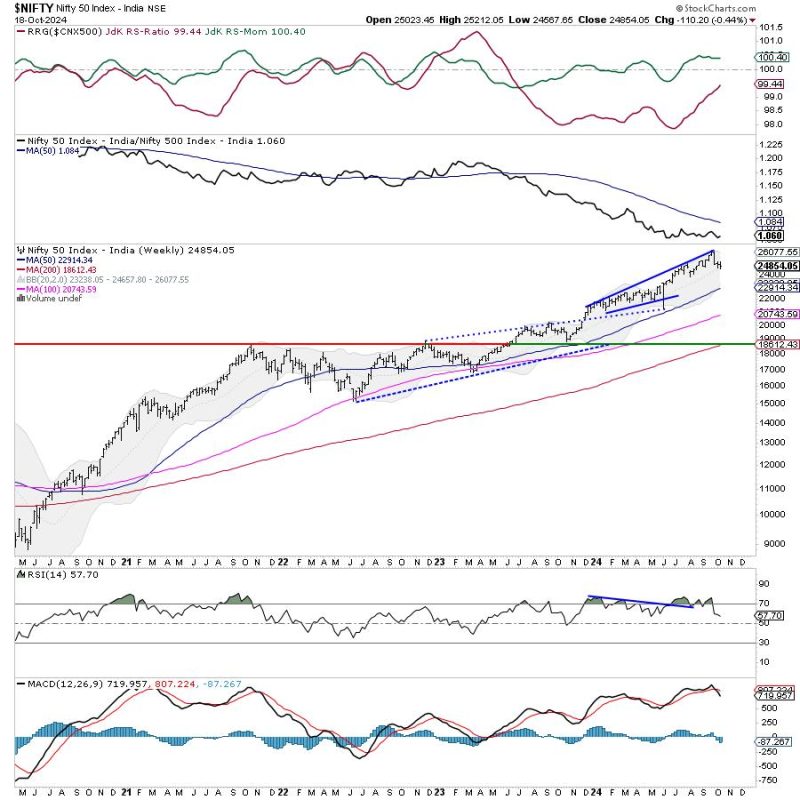

In a recent analysis conducted by financial experts, it is indicated that the upcoming week for the Nifty may see a range-bound movement with potential trending moves only expected if specific edges of the market are breached. This assessment is vital for investors and traders looking to navigate the market and capitalize on potential opportunities.

One of the key factors highlighted in the analysis is the importance of monitoring certain edges in the market. These edges represent crucial levels where significant price movements may occur. By keeping a close eye on these edges, investors can better anticipate potential breakouts or reversals in the market, enabling them to make informed trading decisions.

Furthermore, the analysis emphasizes the need for a cautious approach in the current market environment. With the Nifty expected to remain range-bound in the upcoming week, traders should exercise patience and wait for clear signals before initiating any new positions. By avoiding impulsive trading decisions, investors can reduce the risk of making costly mistakes in a volatile market.

In addition to monitoring key levels and exercising caution, the analysis also suggests that traders should be prepared for potential trending moves in the market. Trending moves can offer significant profit opportunities, but they also carry increased risks. Traders must be equipped with a solid risk management strategy to protect their capital and minimize losses in the event of adverse market movements.

Overall, the analysis provides valuable insights for investors and traders looking to navigate the Nifty market in the upcoming week. By staying informed about key market edges, exercising caution, and being prepared for potential trending moves, traders can enhance their chances of success in a dynamic and ever-changing market environment.