The article explores the ongoing secular bull market, highlighting significant changes and rotations within the financial sector and stock market. It delves into the impact of varying economic conditions and investors’ shifting preferences on different asset classes.

The article begins by acknowledging the sustained secular bull market that has characterized the stock market in recent times. It notes that despite facing occasional corrections and hurdles, the overall trend has been one of growth and optimism. This observation sets the stage for a discussion on the recent major rotations and changes within the market.

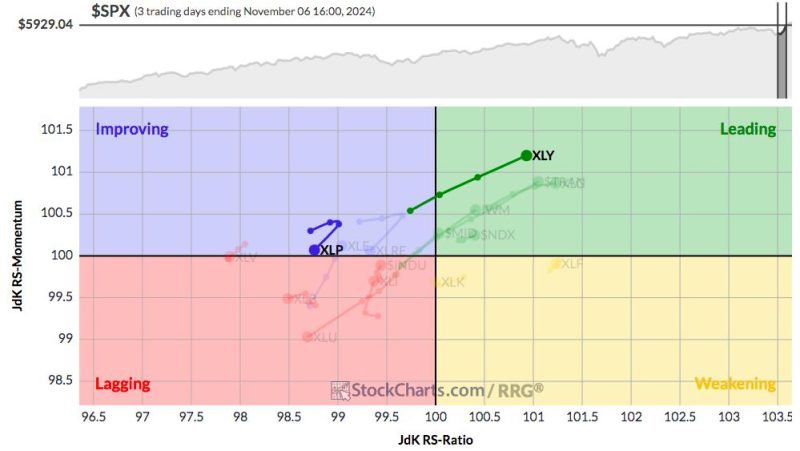

One notable change identified in the article is the shift in focus from certain sectors that have traditionally performed well to others that are now gaining traction. This rotation indicates a reevaluation of investment strategies and a departure from previously favored assets. Such transformations in investor sentiment and behavior play a crucial role in defining the trajectory of the market and individual portfolios.

The article proceeds to analyze the reasons behind the rotations, attributing them to a variety of factors such as changing economic conditions, geopolitical developments, and technological advancements. It emphasizes the importance of understanding these influences to adapt and navigate successfully within the evolving investment landscape.

Furthermore, the article touches upon the concept of risk management and the need for diversification in light of the market’s dynamic nature. It underscores the significance of maintaining a balanced portfolio and being prepared for potential shifts in market trends. By highlighting the benefits of a diversified approach, the article provides valuable insights for investors looking to weather uncertainty and achieve long-term financial goals.

In conclusion, the article reinforces the idea that the secular bull market remains intact but is subject to continual change and adaptation. It encourages investors to stay informed, remain flexible, and be proactive in adjusting their investment strategies to align with the evolving market dynamics. By embracing these principles, investors can position themselves for success in an ever-changing financial landscape.