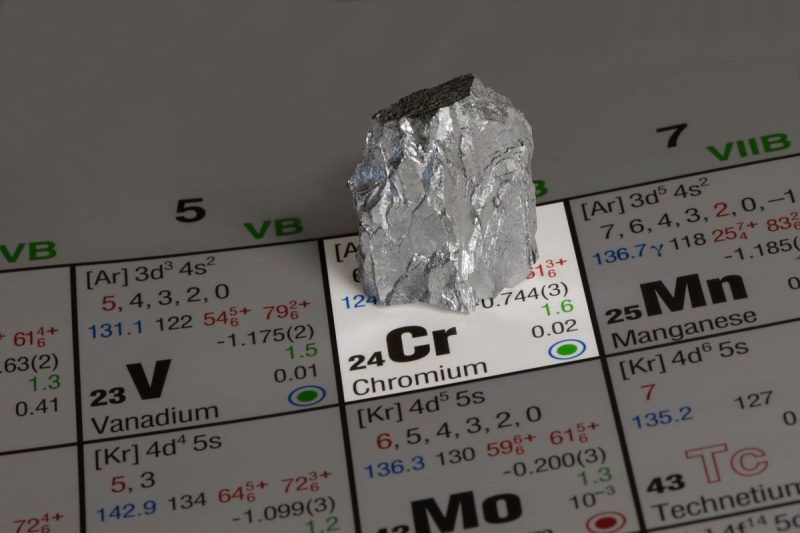

Investing in Chromium Stocks: A Comprehensive Guide for Beginners

Understanding the Chromium Market: Chromium is a crucial industrial metal widely used in various sectors such as stainless steel production, aerospace, and automotive industries. Its unique properties make it a valuable commodity in the global market. As an investor, it is essential to comprehend the dynamics of the chromium market to make informed decisions.

Factors Influencing Chromium Prices: Several factors influence the price of chromium, including global demand and supply, geopolitical instability, economic conditions, and technological advancements. Tracking these factors can help investors anticipate price fluctuations and determine the best time to buy or sell chromium stocks.

Researching Chromium Companies: Before investing in chromium stocks, conduct thorough research on companies operating in the chromium mining and production sector. Evaluate key financial metrics, such as revenue growth, profitability, and debt levels, to assess their financial health and potential for growth.

Diversifying Your Portfolio: Diversification is key to reducing risk in your investment portfolio. Consider investing in a mix of chromium mining companies, diversified metals and mining funds, and exchange-traded funds (ETFs) that track the performance of the metals and mining sector.

Monitoring Market Trends: Stay informed about market trends and developments that may impact the chromium market. Follow relevant news sources, industry reports, and market analysis to stay ahead of market changes and make timely investment decisions.

Consulting with Financial Advisors: If you are new to investing or unsure about how to navigate the chromium market, consider seeking advice from a financial advisor. An experienced advisor can help you develop an investment strategy tailored to your financial goals and risk tolerance.

Long-Term Investment Strategy: Investing in chromium stocks requires a long-term perspective. While the market may experience short-term fluctuations, chromium is a valuable commodity with strong demand drivers that can provide steady returns over time. Develop a sound investment strategy and stick to your plan to achieve your financial goals.

Conclusion

In conclusion, investing in chromium stocks can be a rewarding venture for investors seeking exposure to the metals and mining sector. By understanding the fundamentals of the chromium market, researching companies, diversifying your portfolio, and staying informed about market trends, you can make informed investment decisions and build a well-rounded investment portfolio. Remember to consult with financial advisors, maintain a long-term investment perspective, and stay proactive in monitoring market developments to maximize your investment potential in the chromium market.