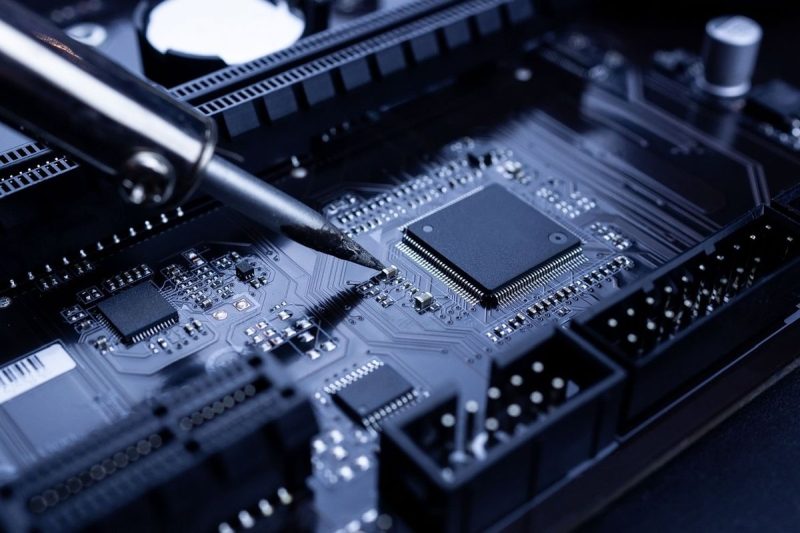

Investing in Tin Stocks: A Valuable Addition to Your Portfolio

Tin is a versatile metal with a wide range of industrial applications, making it an attractive investment option for those looking to diversify their portfolio. As the demand for tin continues to rise in various sectors, including electronics, packaging, and construction, investing in tin stocks can offer significant long-term benefits. Here are some key strategies to consider when investing in tin stocks:

1. Research and Due Diligence

Before diving into tin stocks, it is crucial to conduct thorough research and due diligence on the tin market, including supply and demand dynamics, pricing trends, and the major players in the industry. Understanding the factors that drive the tin market will help you make informed investment decisions and minimize risks.

2. Choose the Right Tin Stocks

When selecting tin stocks to invest in, consider factors such as the company’s financial health, management team, growth prospects, and competitive position in the market. Look for companies with a strong track record of profitability, a diversified portfolio of tin assets, and a solid growth strategy.

3. Monitor Global Trends

Stay informed about global trends that could impact the tin market, such as shifts in supply and demand, geopolitical developments, and advancements in tin production technologies. By keeping a close eye on these trends, you can adjust your investment strategy accordingly and capitalize on emerging opportunities.

4. Diversify Your Portfolio

Diversification is key to building a resilient investment portfolio, especially when it comes to commodities like tin. Consider investing in a mix of tin stocks, ETFs, and mutual funds to spread your risk and maximize potential returns. Diversifying your portfolio can help protect you from sharp fluctuations in the tin market.

5. Long-Term Outlook

Investing in tin stocks requires a long-term perspective, as the tin market can be subject to cyclical trends and price volatility. By adopting a patient and disciplined approach, you can ride out market fluctuations and benefit from the long-term growth potential of tin stocks.

In conclusion, investing in tin stocks can be a rewarding opportunity for investors seeking exposure to a crucial industrial metal with a wide range of applications. By conducting thorough research, choosing the right tin stocks, monitoring global trends, diversifying your portfolio, and maintaining a long-term outlook, you can build a solid foundation for a successful tin investment strategy.