In the ever-evolving landscape of the financial markets, remaining watchful for signs of potential downturns is imperative for investors and market participants alike. As showcased in the insightful article on GodzillaNewz.com, the S&P 500 index serves as a crucial barometer of the overall health of the stock market. By analyzing key indicators and warning signs, individuals can make informed decisions to safeguard their investments and navigate potential market turbulence.

One prominent warning sign highlighted in the article is the concept of market breadth. This refers to the degree to which individual stocks within the index are participating in its movements. A healthy market typically exhibits broad participation, with a majority of stocks rising alongside the index. Conversely, a narrowing breadth, where only a select few stocks are driving gains while others languish, can be a red flag indicating potential weakness.

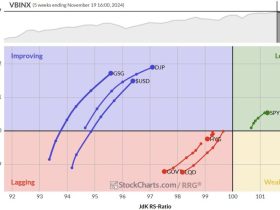

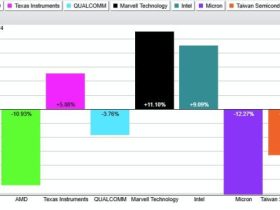

Moreover, the article underscores the significance of technical analysis in gauging market trends and sentiment. Chart patterns, moving averages, and other technical indicators can provide valuable insights into the direction of the market. For instance, a breakdown below key support levels or the formation of bearish patterns may suggest an impending downturn.

Another vital aspect discussed in the article is the impact of macroeconomic factors on stock market performance. Economic indicators such as GDP growth, inflation rates, and unemployment data can influence investor sentiment and market dynamics. By staying attuned to these indicators and their potential implications for corporate earnings and market valuations, investors can better position themselves to weather market downturns.

Additionally, the article emphasizes the role of geopolitics and global events in shaping market trends. Developments such as trade tensions, geopolitical conflicts, and policy changes can introduce volatility and uncertainty into the markets. Keeping abreast of such events and their potential ramifications on the economy and corporate profits is crucial for mitigating risks and identifying investment opportunities.

Furthermore, the article underscores the importance of diversification and risk management in navigating market downturns. Diversifying across asset classes, sectors, and geographies can help spread risk and minimize the impact of adverse market conditions on a portfolio. Employing risk management strategies such as setting stop-loss orders and maintaining a long-term perspective can also aid in preserving capital during turbulent market phases.

In conclusion, staying alert to warning signs and being proactive in monitoring market indicators are essential practices for investors seeking to protect their portfolios and capitalize on opportunities. By leveraging tools such as technical analysis, economic data, and geopolitical insights, individuals can make informed decisions and adapt to changing market conditions effectively. With a keen eye on market dynamics and a disciplined approach to risk management, investors can navigate market downturns with confidence and resilience.