In the world of finance, analyzing the movement of bond yields has always been a critical indicator of market sentiment and economic conditions. Recently, bonds have been making headlines within financial circles due to a concerning development known as the death cross sell signal. This signal has sparked significant buzz and debate among investors and analysts alike, as it carries potential implications for future market performance and economic stability.

Before delving into the details of the death cross sell signal, it is essential to understand some fundamental aspects of bond yields and their significance in the financial landscape. Bonds are fixed-income securities issued by governments or corporations to raise capital. Bond yields, which represent the return an investor receives for holding a bond, are influenced by various factors such as interest rates, inflation expectations, and overall market conditions. Changes in bond yields can reflect shifts in investor sentiment and economic outlook.

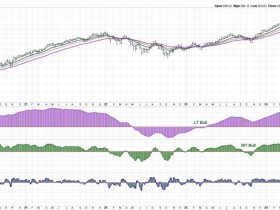

The death cross sell signal, a technical indicator derived from the analysis of bond yield movements, occurs when the short-term moving average of bond yields falls below the long-term moving average. This crossover is interpreted by analysts as a bearish signal, suggesting potential downward pressure on bond prices and a possible indicator of broader market weakness. Investors closely monitor such signals to anticipate market trends and adjust their investment strategies accordingly.

The significance of the death cross sell signal lies in its historical correlation with market downturns and economic recessions. Past instances of this signal have often preceded periods of market volatility and economic uncertainty, prompting investors to adopt defensive positions to safeguard their portfolios. While the signal is not a foolproof predictor of future market performance, its occurrence serves as a cautionary flag for investors to exercise vigilance and consider potential risk mitigation strategies.

In light of the current economic environment characterized by evolving geopolitical dynamics, inflation concerns, and shifting central bank policies, the emergence of the death cross sell signal has captured the attention of market participants seeking insights into future market trends. Analysts are divided on the implications of this signal, with some viewing it as a precursor to a market correction or downturn, while others maintain a more cautious yet optimistic outlook on the resilience of the market.

As investors navigate the complexities of financial markets and assess the implications of the death cross sell signal, it is essential to adopt a diversified investment approach, conduct thorough research, and stay informed about market developments. Maintaining a disciplined investment strategy founded on sound principles of risk management and asset allocation can help investors weather market fluctuations and capitalize on opportunities that may arise amidst uncertainty.

In conclusion, the death cross sell signal in bond yields serves as a critical indicator for investors and analysts to monitor in the ever-changing landscape of financial markets. While its interpretation may vary among market participants, the signal underscores the importance of vigilance, risk management, and strategic decision-making in navigating market volatility and safeguarding investment portfolios. By staying informed, maintaining a balanced approach to investing, and adapting to evolving market conditions, investors can position themselves to navigate challenges and capitalize on opportunities in an increasingly complex financial landscape.