Sector rotation is a key strategy employed by top investors to navigate changing market conditions and maximize returns on their investments. This approach involves shifting assets among different sectors of the economy based on various factors such as economic indicators, market trends, and performance expectations. To effectively track sector rotation and make informed investment decisions, top investors use several methods and tools. Here are three ways in which top investors track sector rotation:

1. Economic Indicators and Market Data Analysis:

Top investors closely monitor economic indicators and market data to identify emerging trends and sectors that are poised for growth. Key indicators such as GDP growth rates, employment data, inflation, and interest rates can provide valuable insights into the overall health of the economy and specific sectors. By analyzing this data, investors can anticipate changes in sector performance and adjust their portfolios accordingly.

Additionally, market data analysis, including sector-specific performance metrics, market indices, and historical trends, allows investors to compare and evaluate the relative strength of different sectors. By tracking these data points, investors can identify sectors that are outperforming or underperforming the broader market and make strategic allocation decisions to capitalize on opportunities or mitigate risks.

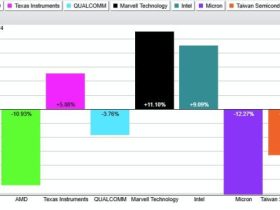

2. Technical Analysis and Relative Strength:

Top investors use technical analysis tools and relative strength indicators to assess the momentum and attractiveness of individual sectors. Technical analysis involves studying price charts, trend patterns, and trading volumes to identify potential entry or exit points in specific sectors. By analyzing these factors, investors can gauge market sentiment, identify key support and resistance levels, and make informed decisions about sector rotation.

Relative strength analysis compares the performance of one sector against another or against the overall market. By tracking relative strength indicators, investors can identify sectors that are showing strong performance compared to others and allocate their assets accordingly. This approach helps investors capitalize on sector trends and potential opportunities for growth.

3. Fundamental Analysis and Sector-Specific Research:

Fundamental analysis plays a crucial role in tracking sector rotation and identifying quality investment opportunities within specific sectors. By conducting in-depth research on individual companies, industries, and sectors, investors can assess key fundamentals such as revenue growth, earnings potential, competitive positioning, and valuation metrics.

Moreover, top investors engage in sector-specific research to understand the drivers of growth and risks affecting different sectors. By analyzing industry trends, regulatory developments, technological advancements, and market dynamics, investors can gain valuable insights into sector rotation opportunities and make well-informed investment decisions.

In conclusion, tracking sector rotation is essential for top investors seeking to optimize their portfolios and achieve superior returns. By leveraging economic indicators, market data analysis, technical analysis, relative strength indicators, fundamental analysis, and sector-specific research, investors can navigate changing market conditions, identify sector trends, and capitalize on lucrative investment opportunities. Adopting a strategic approach to sector rotation can help investors stay ahead of the curve and enhance their overall investment performance.